Panthoibi Housing Finance Company Limited believe that shared financial inclusion is the route to a sustainable and peaceful social existence. We are committed to ensuring financial inclusion to all the people. Developing the housing sector is our main objective and at the same time creating a sound financial institution with a strong foothold is the bigger dream. In the days to come, we hope to expand our reach further to the immediate neighboring states and later to the rest of the country by ensuring financial investments in the housing sector initially and to diversify into different financial ventures. We strongly pledge to our motto “Shelter for All”.

PMAY - CLSS

Panthoibi Housing Finance Company Ltd.

“One of the leading subsidised home loan provider in the Northeastern India under Pradhan Mantri Awas Yojana – Credit Link Subsidy Scheme”

PMAY - CLSS Highlights

# Subsidy up to ₹ 2.67 lakhs for EWS/LIG

# Subsidy up to ₹ 2.35 lakhs for MIG

# Maximum loan tenure of 20 years

PHFCL Highlights

# No penalty on prepayment and foreclosure*

# Interest waive off option*

PMAY - CLSS MIG

Introducing Credit Link Subsidy Scheme for Middle Income Group; Eligible Family or Household Income up to ₹ 18 Lakhs per Annum

Financial Highlights

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | |

|---|---|---|---|---|---|

| Total Revenue | ₹ 1.71 Crores | ₹ 1.80 Crores | ₹ 1.88 Crores | ₹ 2.00 Crores | ₹ 2.39 Crores |

| Authorized Capital | ₹ 15 Crores | ₹ 15 Crores | ₹ 25 Crores | ₹ 25 Crores | ₹ 25 Crores |

| Paid up Capital | ₹ 9.54 Crores | ₹ 9.54 Crores | ₹ 9.54 Crores | ₹ 12.78 Crores | ₹ 17.50 Crores |

* Figures are of 31st March 2023

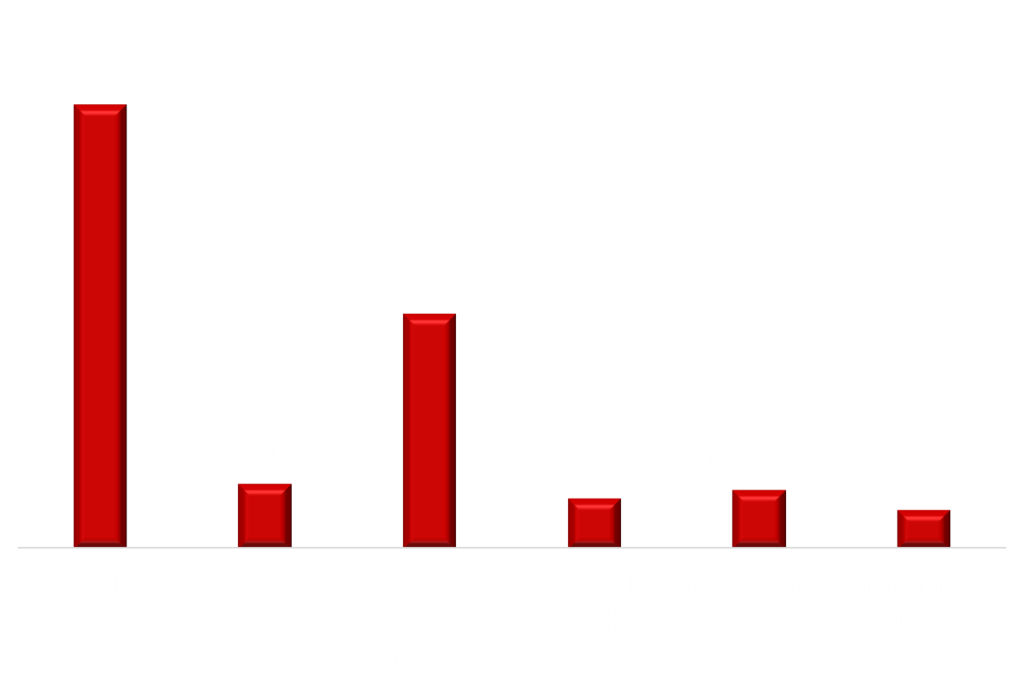

Total Sanctioned Loan Amount as on March 2023

As on March 2023, PHFCL has sanctioned

₹ 39.62 Crores and channelized subsidy to the people of Manipur under PMAY-CLSS

Testimonials

“I never thought of owing a house in the Imphal City. An individual from Churachandpur dream of owning a house is made possible by the grace of God and with the help of Panthoibi Housing Finance Company Limited. I sincerely thank Panthoibi Housing Finance Company Limited for making my dream into reality”.

Milun SiankhanthangM.S. Zoveng, Game Village, Meitei Langol

“I am not a government employee. I never expected that I will build a house one day. With the help of Panthoibi Housing Finance Company Limited, I was able to build a house. I request everyone to kindly visit the company; consult with the well knowledgeable PHCL employee. It does not take much time to make your dream come true”.

Ngangbam (N) Chandrashakhi Devi & Aheibam Loken SinghSingjamei Chingamakha Yanglem Leikai, Imphal

“For a common people like us, it was tough to approach Scheduled and Commercial Banks to avail housing loan. When we heard about Panthoibi Housing Finance Company Limited, we were initially reluctant to approach the company; however, we decided to try our luck. After submitting all the required documents, in a short span of time, we were provided housing loan. Panthoibi Housing Finance Company Limited made our dream of owning a house into reality”.

Oinam Brojeshwori Devi & Oinam Sonamani SinghNingthoukhong Bazaar, Bishnupur District

“We were not able to complete building our house. As my son’s wedding was around the corner, I was worried about building the house on time. With proper documents, loan processing in Panthoibi Housing Finance Company limited, does not take much time. Now, the house is about to be completed and I am sincerely thankful to Panthoibi Housing Finance Company Limited as I can bring my son’s to be wedded bride to our new house”.

Khomdram Chanu Damayanti & Thongam Romenkumar SinghKeishampat Thiyam Leikai, Imphal West

“I don’t have words to express. Owing a Pucca house was our dream. With proper monthly income, one can approach Panthoibi Housing Finance Company Limited and avail housing loan without much hurdle”.

Mayanglambam (O) Riteshwori Devi & Mayanglambam Shanta SinghKakching Turel Wangma Ningthou Pareng, Thoubal District

“We were living in a small congested place. With the housing loan from Panthoibi Housing Finance Company Limited, we were able to extend our house and the subsidy received was of great advantage to us. With unexpected expenditure, we are faced with the difficulty of completing our house. Panthoibi Housing Finance Company Limited has helped us immensely with financial assistance”.

Thiyam Dialakshmi Chanu & G. Nimaichand Sharma Nagamapal Singjubung Leirak, Imphal West